Greenback Common Company DG will launch its fourth-quarter monetary outcomes, earlier than the opening bell, on Thursday, March 13.

Analysts anticipate the Goodlettsville, Tennessee-based firm to report quarterly earnings at $1.5 per share, down from $1.83 per share within the year-ago interval. Greenback Common initiatives quarterly income of $10.26 billion, in comparison with $9.86 billion a 12 months earlier, in line with information from Benzinga Professional.

Greenback Common has missed analysts’ revenue estimates for the final two quarters.

Greenback Common shares fell 4.8% to shut at $74.85 on Wednesday.

Benzinga readers can entry the newest analyst rankings on the Analyst Inventory Rankings web page. Readers can type by inventory ticker, firm identify, analyst agency, ranking change or different variables.

Let’s take a look at how Benzinga’s most-accurate analysts have rated the corporate within the current interval.

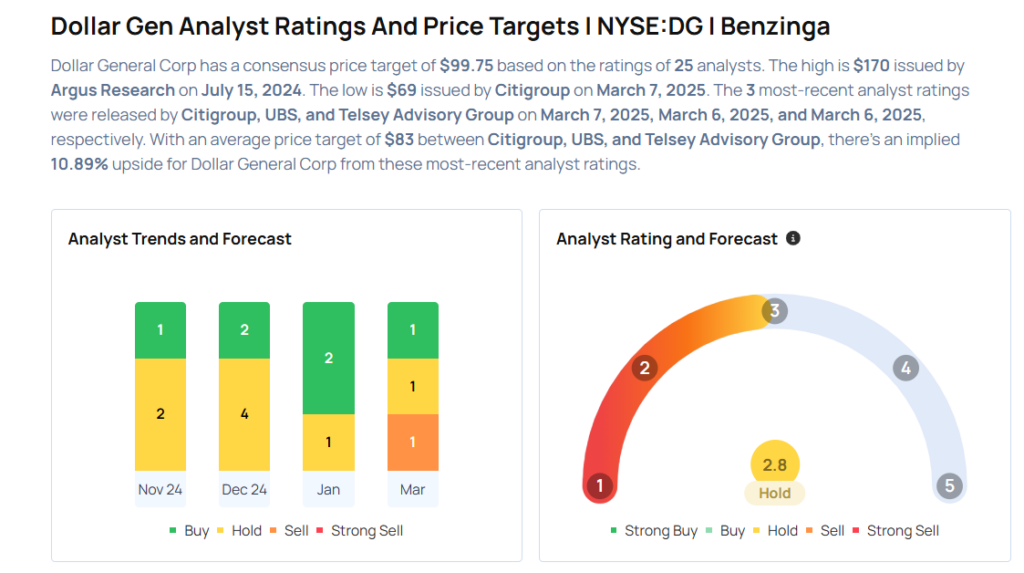

- Citigroup analyst Paul Lejuez maintained a Promote ranking and lower the worth goal from $73 to $69 on March 7, 2025. This analyst has an accuracy fee of 65%.

- UBS analyst Michael Lasser maintained a Purchase ranking and slashed the worth goal from $108 to $95 on March 6, 2025. This analyst has an accuracy fee of 78%.

- Telsey Advisory Group analyst Joseph Feldman maintained a Market Carry out ranking and lower the worth goal from $88 to $85 on March 6, 2025. This analyst has an accuracy fee of 67%.

- Deutsche Financial institution analyst Krisztina Katai downgraded the inventory from Purchase to Maintain and slashed the worth goal from $90 to $80 on March 3, 2025. This analyst has an accuracy fee of 63%.

- Goldman Sachs analyst Kate McShane maintained a Purchase ranking and lower the worth goal from $104 to $93 on Jan. 23, 2025. This analyst has an accuracy fee of 67%.

Contemplating shopping for DG inventory? Right here’s what analysts suppose:

Learn This Subsequent:

Momentum17.46

Progress71.20

High quality14.02

Worth55.92

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.