Whereas some publicly traded corporations are both distinctly a long-term funding or a near-term buying and selling alternative, a choose few supply sturdy alerts for each attributes. One such thought could also be CyberArk Software program Ltd CYBR. A specialist in privileged entry administration (PAM), CyberArk gives basic relevance. In any case, cybercriminals by no means relaxation due to financial challenges. As such, CYBR inventory makes for an intriguing low cost.

In February, CyberArk disclosed its outcomes for the fourth quarter of fiscal 2024, posting income of $314.4 million. This determine represented a 41% year-over-year raise and in addition beat the consensus view of $301.31 million. On the underside line, the cybersecurity specialist delivered adjusted earnings per share of 80 cents, exceeding the consensus goal of 72 cents.

Of explicit observe was the corporate’s annual recurring income (ARR) line merchandise, which elevated 51% from the prior yr to $1.17 billion. Additional, the subscription portion of ARR clocked in at $977 million, implying 68% development from the year-ago quarter.

Through the convention name, CyberArk CEO Matt Cohen highlighted sturdy demand for the corporate’s id safety options as a significant catalyst. This assertion tracks with outdoors sources. In line with Grand View Analysis, the worldwide PAM market generated income of over $3.28 billion final yr. By 2030, the sector could possibly be price over $9.38 billion, implying a compound annual development price of 19.7%.

Nonetheless, CYBR inventory was not proof against wider financial considerations that impacted the market, significantly the expertise sector. With President Donald Trump partaking in high-tempo diplomatic measures — significantly by the usage of tariffs — the S&P 500 technically fell into correction territory on Thursday.

Put one other manner, CyberArk seems to be a superb firm that simply occurs to come across dangerous circumstances outdoors its management. This setup makes CYBR inventory intriguing for bullish speculators.

A number of Indicators Level to a Potential Restoration

For risk-tolerant traders, a number of indicators level to a doable restoration in CYBR inventory. At the beginning is the underlying firm’s “everlasting” relevance. Sure, CYBR popped greater resulting from easing fears concerning a authorities shutdown. Regardless of Washington politics, nonetheless, CyberArk’s significance to the tech ecosystem won’t be impugned.

Once more, no matter occurs within the political or financial entrance, nefarious actors will proceed to search for and exploit vulnerabilities. In reality, some analysis signifies that financial pressures might increase cybersecurity dangers. Such a dynamic would probably contribute constructive sentiment to CYBR inventory.

One other signal to think about is Wall Avenue’s evaluation of CyberArk’s enterprise. Again when CYBR inventory traded fingers for round $355, Financial institution of America Securities analyst Madeline Brooks elevated the worth goal for the fairness to $500. On the time of this writing, CYBR is buying and selling at an roughly 5% low cost to Brooks’ authentic place to begin.

Extra importantly, the analyst’s reasoning for the bullish name stays as pertinent as ever. As Brooks acknowledged in a analysis observe to purchasers, id safety has advanced to turn into a “foundational pillar in cybersecurity.”

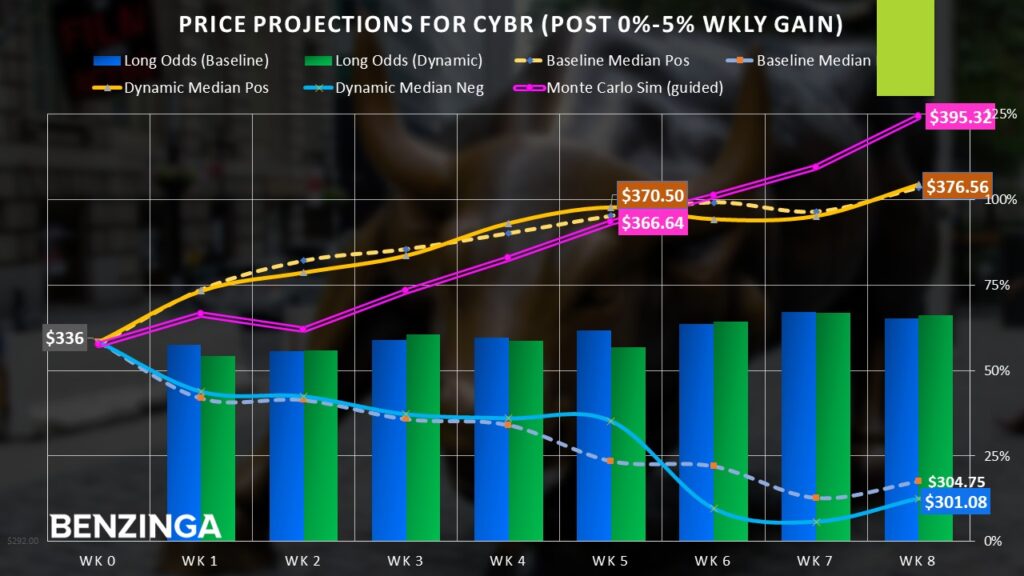

Lastly, for merchants particularly, the statistical backdrop seems compelling. Utilizing pricing information from January 2019, CYBR inventory has demonstrated an upward bias. As a baseline, a protracted place held for any given eight-week stretch has a 65.19% likelihood of rising.

In the meanwhile, CYBR inventory is on tempo to rise round 3% this week. Modest momentum like this does little to alter the fairness’s behavioral dynamics — such parameters statistically yield the same magnitude of upward mobility.

Two Methods To Strategy CyberArk Software program

With the above market intelligence in thoughts, there are two fundamental approaches accessible for CYBR inventory. First, one might merely purchase shares within the open market. That is essentially the most simple method and it is fairly intriguing. Presently, the consensus worth goal stands at $402.81, implying about 19% or 20% upside.

That stated, the extra thrilling — although considerably riskier — pathway is to deploy the leverage of choices. Particularly, traders could wish to think about the 350/360 bull name unfold for the April 17 expiration date. This transaction entails shopping for the $350 name (at a $1,340 ask) and concurrently promoting the $360 name (at a $760 bid).

The above bull unfold arguably makes rational sense as a result of beneath baseline situations, CYBR is projected to succeed in $367.52 over the following 5 weeks, greater than sufficient to set off the brief name strike worth at expiration. Below dynamic situations of modest momentum, a five-week return might land CYBR at $369.75.

Operating a Monte Carlo simulation utilizing market practical parameters based mostly off CYBR’s pricing historical past reveals a median goal of round $368. Whereas these components aren’t any assure that CyberArk’s fairness will reply as predicted, the sheer variety of tailwinds might entice speculators to make the leap.

Photograph: Shutterstock

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.