Because the S&P 500 enters right into a correction zone, main economists weigh in on whether or not the U.S. financial system is headed towards a recession amid an escalating commerce battle.

What Occurred: Lawrence H. Summers, former U.S. Treasury Secretary, lambasted latest tariff insurance policies, warning of potential recession dangers and destructive long-term penalties. In an interview with CNN on Thursday, Summers described these tariff insurance policies as a “self-inflicted wound” that not solely raises prices for companies and shoppers but additionally poses a risk to nationwide safety. He additional said that these insurance policies are alienating allies whereas benefiting rivals in Asia and Europe.

Summers additionally highlighted the financial uncertainty brought on by these insurance policies, stating that it discourages spending and funding, which may doubtlessly gradual progress. He dismissed the thought of damaging the financial system to strain the Federal Reserve into reducing curiosity charges as a flawed technique.

He warned that the chances of a U.S. recession have risen from 10-15% to almost 50%, primarily on account of coverage shifts. Summers cautioned that arbitrary tariff will increase and spending cuts may have long-term destructive penalties.

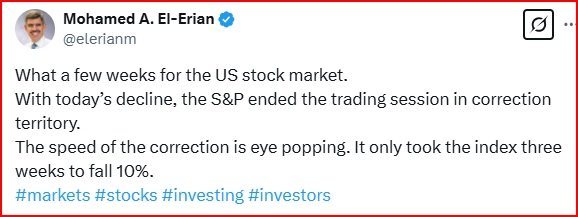

In the meantime, Mohamed El-Erian, known as the velocity of the correction ‘eye popping’ in his publish on X, following the S&P 500’s 10% drop in three weeks. In his earlier posts, he said that he expects vital downward revisions to the U.S. 2025 progress projections from the IMF and Wall Avenue corporations, starting from 0.5 to a full proportion level, in comparison with the preliminary consensus forecast of two.5% at first of the 12 months.

Nonetheless, Justin Wolfers, Senior Fellow at Brookings Institute, nonetheless holds on to bits of optimism amid pessimism. He informed CNN {that a} recession is ‘not inevitable,’ whereas reasoning that President Donald Trump has inherited a powerful U.S. financial system and he hasn’t been on the helm lengthy sufficient to alter a lot of that.

Nonetheless, he acknowledged that this time, as a substitute of exterior components, the chaotic financial insurance policies from the White Home are a trigger for concern. Wolfers defined how these insurance policies are main companies and shoppers to pause spending, which ‘may’ however ‘not at all essentially’ spark a recession.

SEE ALSO: Ripple-SEC Lawsuit Nears Finish: Will XRP Be Labeled As Commodity Like Ethereum?

Why It Issues: The feedback from numerous economists come within the wake of escalating commerce tensions. On Thursday, the S&P 500 entered technical correction territory, falling 10% from its all-time excessive, following Trump’s newest tariff threats whereby he threatened to impose a 200% tariff on French champagne and EU spirits.

The S&P 500, as tracked by the SPDR S&P 500 ETF Belief SPY, closed at 5,521 factors, marking a big drop from its February 19 peak of 6,147. This contemporary wave of promoting was triggered by escalating commerce tensions, reinforcing economists’ issues concerning the potential destructive impression of latest tariff insurance policies on the financial system.

Learn Extra:

Picture by way of Shutterstock

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Momentum68.31

Development–

High quality–

Worth–

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.