The S&P 500 index jumped over 2% on Friday, after a fall into the correction zone on Thursday final week, whereas the Nasdaq continues to be within the correction territory. Whereas technical evaluation factors towards bearish developments, this analyst says that traders can begin searching for purchase alerts.

What Occurred: As of Friday, the S&P 500 index was 8.27% down from its 52-week excessive, which adopted a bounce from Thursday’s 10.18% drawdown. Equally, Nasdaq 100 was 11.33% decrease from its 52-week excessive as of Friday.

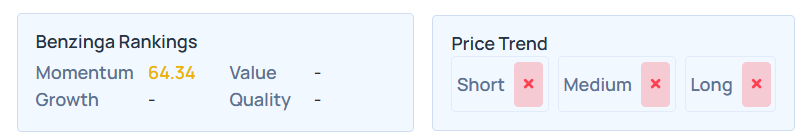

Based on Benzinga Professional and Edge Rankings, the technical evaluation of the exchange-traded fund monitoring the S&P 500 index, SPDR S&P 500 ETF Belief SPY had been flashing warning alerts.

Regardless of that Jay Kaeppel, the senior market analyst at SentimenTrader through his Panic/Euphoria evaluation mannequin confirmed that the S&P 500’s decline was nonetheless not flashing a purchase sign. Nevertheless, from this level, traders may “Begin searching for a purchase sign”.

Based on the chart shared by him, when the Panic/Euphoria line falls beneath the Extreme Pessimism degree, traders may anticipate a bounce again with a mean of over 7% return after two months and 28% returns after a yr. However, this follows a collection of pink dots representing that traders ought to take a backseat.

Therefore, as his mannequin exhibits the presence of just one pink dot, Kaeppel doesn’t forecast a purchase but, however the begin of a probably rising purchase sign.

See Additionally: Warren Buffett Plans To Promote His Actual Property Brokerage, However It’s ‘Not… A Wager Towards US House Costs,’ Says Analyst As Fed Expects To Maintain Charges Unchanged

Why It Issues: SPY fell beneath its 200-day transferring common on Thursday after its longest-ever streak and its technical charts confirmed that it was beneath all its brief and long-term transferring averages. The MACD momentum indicator was damaging 11.38, signaling a downtrend within the short-term and its relative energy index of 37.72 was within the impartial zone.

Equally, the Edge Rankings confirmed that SPY had a poor worth development in brief, medium, and long run, with a momentum rating of 64.34 percentile.

Worth Motion: The SPY and Invesco QQQ Belief ETF QQQ, which observe the S&P 500 index and Nasdaq 100 index, respectively, rose on Friday. The SPY superior 2.07% to $562.81, and the QQQ additionally jumped 2.42% to $479.66, in response to Benzinga Professional knowledge.

Learn Subsequent:

Photograph courtesy: Shutterstock

Momentum64.34

Development–

High quality–

Worth–

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.