Williams-Sonoma, Inc. WSM will launch its fourth-quarter monetary outcomes, earlier than the opening bell, on Wednesday, March 19.

Analysts anticipate the San Francisco, California-based firm to report quarterly earnings at $2.93 per share, up from $2.72 per share within the year-ago interval. Williams-Sonoma initiatives quarterly income of $2.35 billion, in comparison with $2.28 billion a 12 months earlier, in accordance with information from Benzinga Professional.

On Nov. 20, 2024, Williams-Sonoma reported better-than-expected third-quarter monetary outcomes and accredited a $1 billion inventory repurchase authorization.

Williams-Sonoma shares rose 4.5% to shut at $175.00 on Monday.

Benzinga readers can entry the newest analyst rankings on the Analyst Inventory Rankings web page. Readers can kind by inventory ticker, firm identify, analyst agency, score change or different variables.

Let’s take a look at how Benzinga’s most-accurate analysts have rated the corporate within the latest interval.

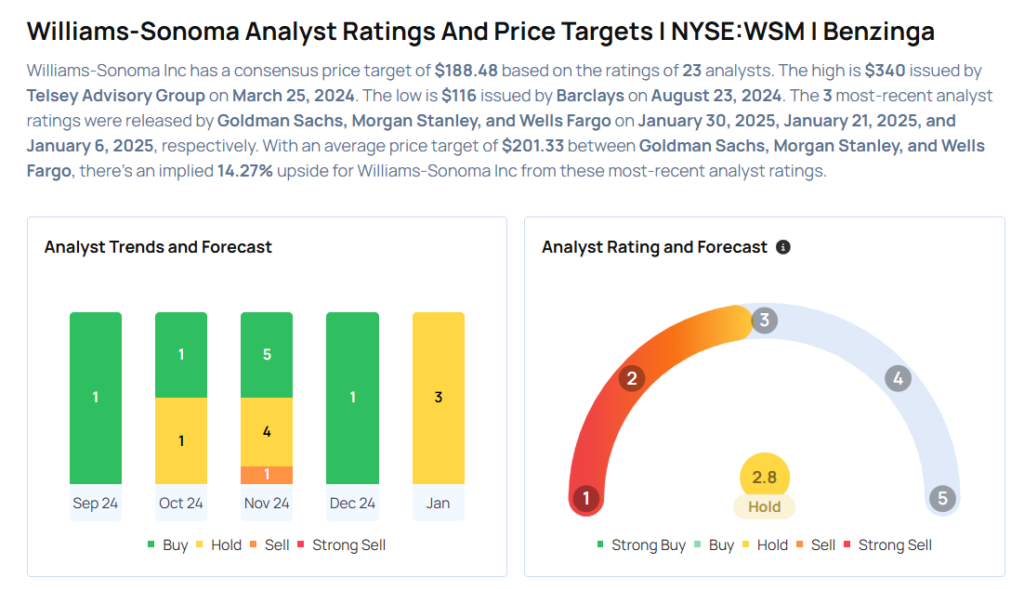

- Goldman Sachs analyst Kate McShane maintained a Impartial score and elevated the value goal from $170 to $224 on Jan. 30, 2025. This analyst has an accuracy price of 67%.

- Morgan Stanley analyst Simeon Gutman maintained an Equal-Weight score and raised the value goal from $170 to $195 on Jan. 21, 2025. This analyst has an accuracy price of 67%.

- Wells Fargo analyst Zachary Fadem maintained an Equal-Weight score and raised the value goal from $165 to $185 on Jan. 6, 2025. This analyst has an accuracy price of 84%.

- Wedbush analyst Seth Basham maintained a Impartial score and raised the value goal from $135 to $175 on Nov. 21, 2024. This analyst has an accuracy price of 68%.

- TD Cowen analyst Max Rakhlenko maintained a Purchase score and boosted the value goal from $165 to $195 on Nov. 21, 2024. This analyst has an accuracy price of 64%.

Contemplating shopping for WSM inventory? Right here’s what analysts suppose:

Learn This Subsequent:

Momentum83.54

Progress28.32

High quality96.81

Worth49.39

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.